Textile Industry in USA. Present and future

Interview with Shannon McCarthy – General Manager Datatex USA

Shannon McCarthy – Having earned degrees in Textiles and Business Administration, Shannon puts his knowledge and experience to work improving processes and information systems in textile and apparel companies. Specializing in Costing, Supply Chain planning and scheduling, he has worked with companies on all seven continents in his 25+ years at Datatex.

Shannon McCarthy – Having earned degrees in Textiles and Business Administration, Shannon puts his knowledge and experience to work improving processes and information systems in textile and apparel companies. Specializing in Costing, Supply Chain planning and scheduling, he has worked with companies on all seven continents in his 25+ years at Datatex.

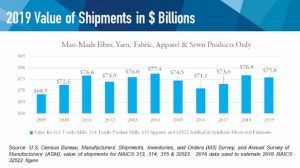

The textile sector in the United States, as has also happened in Europe, has undergone considerable downsizing over the last thirty years, in favor of delocalization of production to other areas of the world (Asia, Central and South America, Africa). In recent years, however, there has been an increase in U.S. production and textile exports from the United States, it is becoming more convenient to produce locally and a reshoring phenomenon is gaining ground in companies in the sector. Is this true? What is the situation like today?

The latest export data available is pre-2020 and exports from the US have been trending upward over the recent years. Certainly, the pandemic has impacted consumption of apparel fabrics, but the outlook beyond the pandemic is positive for U.S manufacturers. One reason being that a new trade agreement went into effect in 2020 between the United States, Mexico, and Canada (known as USMCA in the U.S., CUSMA in Canada and T-MEC in Mexico) that is meant to support “mutually beneficial trade leading to freer markets, fairer trade, and robust economic growth in North America,” according to the U.S. Government. Most trade associations in the U.S. see the agreement in a positive light and expect the impact to be positive on export figures. Many of the pre-existing rules from the 1994 NAFTA agreement remain and stricter requirements on sourcing certain apparel items from North America were added, which should positively benefit the sewing thread, narrow elastics, coated fabrics, and pocket lining manufacturers in the region.

manufacturers. One reason being that a new trade agreement went into effect in 2020 between the United States, Mexico, and Canada (known as USMCA in the U.S., CUSMA in Canada and T-MEC in Mexico) that is meant to support “mutually beneficial trade leading to freer markets, fairer trade, and robust economic growth in North America,” according to the U.S. Government. Most trade associations in the U.S. see the agreement in a positive light and expect the impact to be positive on export figures. Many of the pre-existing rules from the 1994 NAFTA agreement remain and stricter requirements on sourcing certain apparel items from North America were added, which should positively benefit the sewing thread, narrow elastics, coated fabrics, and pocket lining manufacturers in the region.

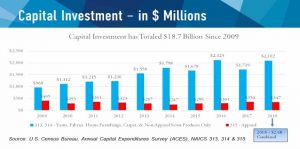

United States domestic production options anecdotally seem to be increasing. There are certainly news stories and industry press  releases that show both a gain in startups and new construction of production facilities by existing companies. Some companies are growing their core business and other are diversifying into new industry segments. Some higher end apparel manufacturing has returned. Also, some international companies have invested in manufacturing in the U.S., particularly in automotive fabrics, technical products, and yarn. The data available also supports this as capital investment continues a strong upward trend.

releases that show both a gain in startups and new construction of production facilities by existing companies. Some companies are growing their core business and other are diversifying into new industry segments. Some higher end apparel manufacturing has returned. Also, some international companies have invested in manufacturing in the U.S., particularly in automotive fabrics, technical products, and yarn. The data available also supports this as capital investment continues a strong upward trend.

Cotton plantations are one of the symbols of the history of the Southern United States. The world has changed, but still today the USA is the third largest producer of cotton in the world, right after China and India. How is the situation of the sector today?

As with Textiles overall, yarn exports are down since 2018, from $4.44 Billion to $4.27 Billion in 2019 and dropping to $3.16 Billion in 2020 according to the U.S. Department of Commerce International Trade Administration Office of Textiles and Apparel (OTEXA). However, the expectation is the sector will return and continue to be strong. As previously mentioned, the USMCA and increased domestic production should both increase U.S. Cotton consumption. An increased consumer desire for sustainable items will positively impact the consumption of U.S. cotton as domestic production generally has a lower carbon impact due to reduced shipping and cleaner manufacturing practices plus U.S. yarn companies are well regarded when it comes to sustainability.

As previously mentioned, the USMCA and increased domestic production should both increase U.S. Cotton consumption. An increased consumer desire for sustainable items will positively impact the consumption of U.S. cotton as domestic production generally has a lower carbon impact due to reduced shipping and cleaner manufacturing practices plus U.S. yarn companies are well regarded when it comes to sustainability.

In addition to cotton, which are – from the point of view of products and supply chain – other excellences of Made in USA textiles? Which are the most important states and areas for textile manufacturing?

The industry is very diverse. Certainly, floor covering is a significant segment of the industry. Technical textiles play an important role in the U.S. industry as well, ranging from non-wovens for healthcare applications to geo-textiles that support construction and the environment to leading edge smart textiles that incorporate electronics into the textiles for various purposes. Use of recycled fibers and repurposed materials continue to grow in this country as well.

Most of the textile manufacturing is around the Southeast and West Coast of the United States. These areas have an advantage of being close to ports for shipping. The South has relatively less expensive land prices and is where the cotton grows. The West Coast is home to many fashion companies and allows for quick delivery to support that industry and shares a border with Mexico for logistic considerations. Similarly, Texas leverages their proximity to Mexico and a strong agricultural base as well. However, companies specializing in technical textiles or mini factories specializing in small order quantity apparel items are being located all over the country, close to the research that drives them or their consumer.

Covid has had a heavy impact all over the world. How is the emergency experienced in the United States and what consequences has it had on the textile sector?

The negative impact of Covid has been significant on the US textile sector overall, as mentioned in previous statistics.

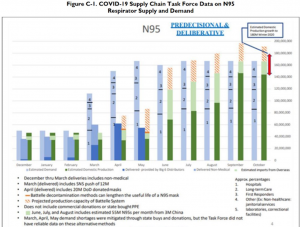

There are some bright spots though.  Companies that manufacture textiles for healthcare purposes saw an increase in demand for their products. Also, as the virus spread demand for Personal Protective Equipment (PPE) reached a critical level and government reserves were consumed. The U.S. textile industry responded to this crisis by pivoting from their traditional products to building a new supply chain to meet the country’s need for PPE. Companies united to meet this critical need and competitors became collaborators and partners, from fiber to finished product, from large industry leaders to smaller companies and new startups. For example, this graph from the Congressional Research Service “COVID-19 and Domestic PPE Production and Distribution: Issues and Policy Options” research paper shows how dramatically N95 domestic production increased month-to-month in the United States.

Companies that manufacture textiles for healthcare purposes saw an increase in demand for their products. Also, as the virus spread demand for Personal Protective Equipment (PPE) reached a critical level and government reserves were consumed. The U.S. textile industry responded to this crisis by pivoting from their traditional products to building a new supply chain to meet the country’s need for PPE. Companies united to meet this critical need and competitors became collaborators and partners, from fiber to finished product, from large industry leaders to smaller companies and new startups. For example, this graph from the Congressional Research Service “COVID-19 and Domestic PPE Production and Distribution: Issues and Policy Options” research paper shows how dramatically N95 domestic production increased month-to-month in the United States.

Growth was experienced in domestic manufacturing of other products, such as gowns and surgical masks as well as PPE for consumer purposes. The PPE industry is expected to continue to grow and some of the companies that responded to the country’s need will stay in this segment whereas others will return to their previous business segment now that the urgent crisis has been met. Also, industry experts expect the increased consumer demand for hygiene products to become the normal behavior after the pandemic passes, which should keep sales of non-wovens and wipes higher than the pre-pandemic levels.